As organizations continue to grow, there is an increasing demand for merchant profiles. Nonetheless, not all the companies are considered equal with regards to merchant profiles. Those considered to be at dangerous of scams, chargebacks, as well as other economic requirements may have trouble receiving vendor balances. In this post, we’ll explore higher-threat vendor balances and what it requires to deal with them.

What is a Higher-Chance Processing Account?

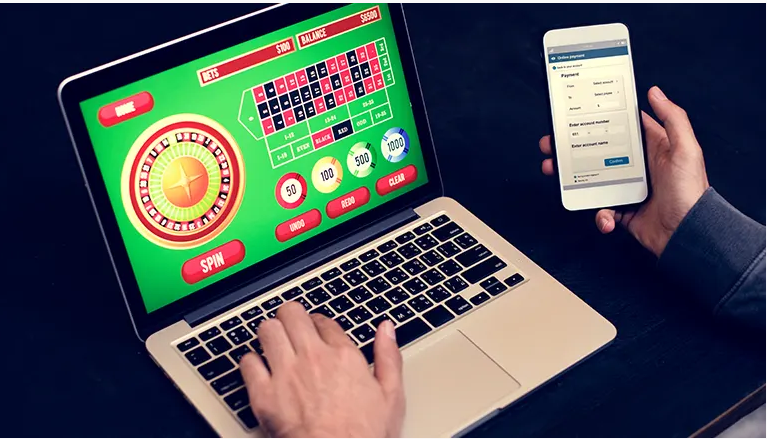

Great-risk service provider balances are specially created for firms that operate in market sectors which are regarded as being high-chance. Many of these businesses incorporate mature enjoyment, on-line video gaming, journey services, yet others. These businesses tend to be much more vunerable to chargebacks, scams, and high risk merchant account uk authorized liabilities, amid other monetary responsibilities. For that reason, a lot of loan companies and merchant card account service providers reject to do business with them.

Why do Businesses Need to have Substantial-Threat Service provider Accounts?

Firms that need great-chance service provider balances incorporate those that function in higher-danger market sectors in need. For example, on the web gaming sites depend on such profiles to facilitate deals using their consumers. Without having these balances, they manage the danger of missing important online business offerings. In addition, higher-threat merchant balances supply organizations access to distinctive functions for example scam recognition and chargeback prevention equipment.

How to Get a High-Threat Merchant Card Account

To acquire a substantial-threat processing account, companies should be ready to go through a far more thorough program method. Normally, processing account suppliers will carry out a danger evaluation of a business’s functioning, monetary functionality, and other pertinent aspects before giving them usage of a very high-risk processing account. Moreover, the functioning and fiscal overall performance of any great-threat business will probably be closely watched from the merchant card account service provider.

Operating a High-Danger Credit Card Merchant Account

Managing a great-chance processing account successfully demands employing a variety of methods and techniques. One of the more main reasons of managing a substantial-risk merchant card account is making sure that you will be always on top of chargebacks. Including getting proactive in responding to client complaints and disputes. In addition, businesses should center on boosting their scams recognition and avoidance capabilities. This could be attained through a mix of unit studying and human being investigative steps.

Simply speaking:

As increasing numbers of companies embrace digital panorama, the requirement for high-threat service provider profiles is growing. However, to get around the turbulent seas of high-risk service provider profiles, enterprises must realize the potential risks concerned and take proper actions to mitigate them. Together with the right instruments, tactics, and methods, organizations can mitigate scam, chargebacks, and other economic threats.