When it comes to trading, there are many options available in the market. One of the most popular trading options is Cfd trading. CFDs or Contract For Difference are derivatives that traders use for speculating on the price movement of an underlying asset. It is a relatively new financial instrument that has gained tremendous popularity in recent years, mainly because of its profit potential. In this blog post, we will delve into the world of Cfd trading, explore its features, and understand how traders can take advantage of it to realize big profits.

Cfd trading is highly popular among traders because it allows them to trade a vast range of financial instruments, including forex, stocks, commodities, and indices. Traders can buy or sell CFDs based on their market analysis and speculate on the price movement of their chosen asset. The profit potential in cfd trading comes from the ability to leverage your trades. Leverage is a mechanism that allows traders to trade with only a fraction of the total value of the asset they are trading. It means that traders can increase their exposure to the market with limited capital, hence enhancing their profit potential.

Another reason why Cfd trading has become so popular is that it offers flexibility in terms of trading hours. Unlike traditional markets, CFDs can be traded 24/7, which means that traders can take advantage of market volatility anytime they want. Additionally, Cfd trading allows traders to go long or short on their trades, depending on the market conditions, allowing them to profit even when the market is going down.

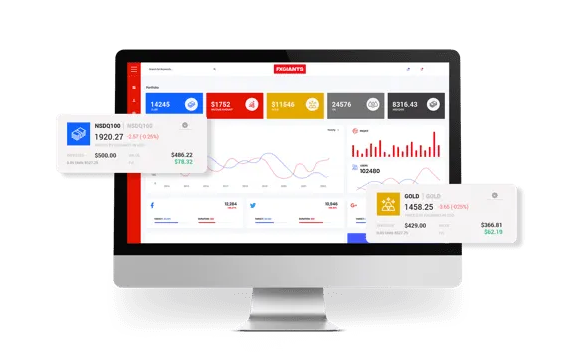

Cfd trading platforms are also user-friendly and offer traders access to advanced trading tools and features such as stop-loss orders, take-profit orders, and price alerts. These features can help traders manage their risks and make informed trading decisions, maximizing their profit potential.

However, as with any financial instrument, Cfd trading involves risks. The leverage that Cfd trading offers can work both ways, amplifying your profits and losses. So traders must have a solid risk management strategy in place before entering into Cfd trading. Therefore, it is essential to start with a demo account and familiarize yourself with the trading platform before trading with real money.

short:

In short, Cfd trading is a high-risk, high-reward financial instrument that has become incredibly popular among traders. With its vast range of financial instruments, flexible trading hours, and user-friendly trading platforms loaded with advanced trading features, Cfd trading offers an ideal opportunity for traders to realize big profits. However, it is vital to remember that potential profits come with potential risks, and traders must have a sound risk management strategy in place to avoid any significant losses. So, if you choose to venture into the world of Cfd trading, make sure you do so with caution and the proper knowledge of the financial instrument.