A contract or an agreement between Two parties wherein sell and both parties agree to purchase a particular asset at a date in the future and at a predetermined price, with a eth to usd volume. These contracts have been held at an established stock market.

Generally, futures trading refers To speculating on interest rates currencies, stocks and also stocks. As it deals with the stakes in the prices of all securities, such trading is highly a risky part of the market.

A futures agreement provides you to be financially relieved in case you have a precise directional perspective on the security and strength rates.

Characteristics Of Future Trading

Futures contracts can be Characterized at these points:

A futures contract is an improvisation over the Forwards contract

A futures contract is money, i.e, you can move the contract to someone else at any point of time and get out of the deal

The futures exchange is highly regulated by the regulatory authority

being fully standardized contract, a futures contract has given variables of the agreement

The transactional structure of this Forwards contract is inherited by the Securities contract

Types Of Forex Agents

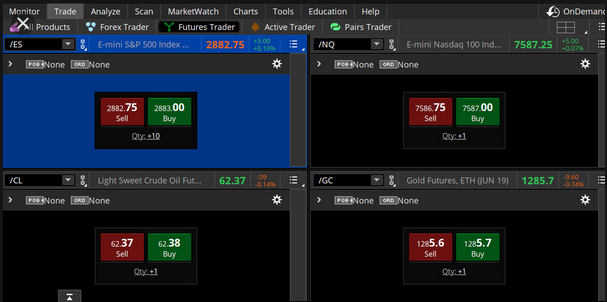

The assets traded in futures Contracts comprise stocks, bonds, and commodities. The two kinds of futures traders are Hedgers and Speculators.

Speculators are not in to accepting Possession of the assets. They often hold stakes regarding the future prices of merchandise that are certain. They frequently get blamed for price swings that were significant, but indeed they provide the futures exchange with major liquidity.