The forex (foreign exchange) market has become a trending space for individuals keen to leverage their financial skills and reap profitable returns. Yet, only a fraction of traders consistently achieve success. If you’re looking to join this elite group in 2024, implementing the right strategies and staying updated on market trends will be crucial.

Understand Forex Trading Basics

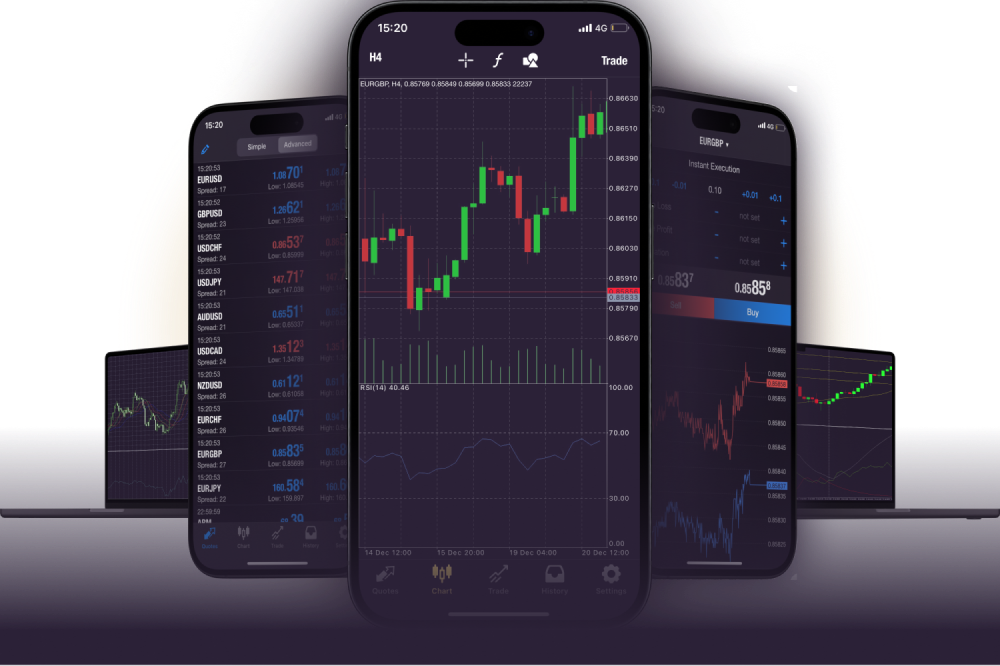

Forex Trading involves buying and selling currency pairs, aiming to profit from fluctuations in exchange rates. The market operates 24 hours a day, from Monday to Friday, with global trading hubs such as London, New York, and Tokyo driving most activities. Understanding key concepts like currency pairs (e.g., EUR/USD), leverage, margin, and pips is critical before embarking on your trading journey.

Research from finance platforms reveals that nearly 90% of beginner traders lose money due to inadequate preparation or poor strategy. Laying a strong foundation through education is the first step toward thriving in this competitive market.

Develop a Solid Trading Strategy

Successful forex traders rely on meticulously defined trading strategies. This includes choosing between short-term tactics such as scalping or day trading and longer-term methods like swing or position trading.

It’s important to select a plan that aligns with your risk tolerance, time commitment, and financial objectives. According to market studies, traders who committed to a single strategy for at least six months outperformed those frequently switching approaches. Consistency is a major factor in long-term profitability.

Focus on Risk Management

Forex trading inherently involves risk, making risk management a non-negotiable element of success. One widely accepted rule is the 1% rule, where traders risk no more than 1% of their account balance on a single trade.

Utilizing tools like stop-loss orders also prevents excessive losses by automatically closing trades when a set limit is reached. A 2022 industry report showed that traders implementing rigorous risk management practices experienced 30% higher retention in the market compared to those who neglected this aspect.

Stay Updated on Market Trends

The forex market is heavily influenced by global events, from central bank policies to geopolitical developments. Remaining informed through reliable financial news outlets and economic calendars empowers traders to make informed decisions.

For example, fluctuations in 2023 were often linked to changes in interest rates by the Federal Reserve, underscoring the importance of staying ahead of similar trends in 2024.