In the fast-paced world of financial markets, staying connected and responsive to market movements is essential for investors. MetaTrader 4 (MT4) facilitates this need through its mobile trading capabilities, allowing investors to engage in trading activities on the go. This article explores mobile trading strategies for the modern investor, emphasizing the flexibility and convenience offered by mt4 trading platform mobile platform.

### **Seamless Transition from Desktop to Mobile**

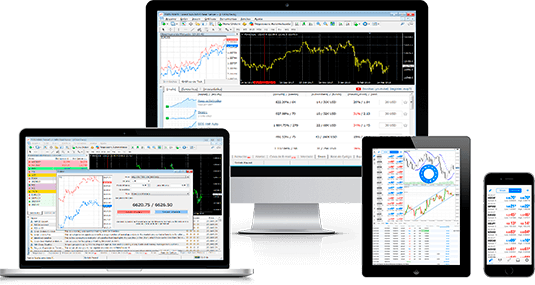

MT4’s mobile application ensures a seamless transition for investors who are constantly on the move. Whether commuting, traveling, or simply away from their desktops, investors can access their MT4 accounts with ease. The mobile platform retains the same user-friendly interface and features as the desktop version, allowing investors to maintain a consistent trading experience across devices.

### **Utilizing Push Notifications for Real-Time Alerts**

Modern investors need to stay informed about market developments, and MT4’s mobile app facilitates this through push notifications. Investors can set up alerts for price movements, news events, or changes in market conditions. Real-time notifications empower investors to make timely decisions, seize opportunities, or manage risks even when they are not actively monitoring the markets.

### **Executing Trades Anytime, Anywhere**

The ability to execute trades on the go is a game-changer for modern investors. MT4’s mobile platform enables investors to place market orders, set pending orders, and manage existing positions from the palm of their hands. This flexibility ensures that investors can capitalize on market opportunities or adjust their portfolios without being tethered to a desktop computer.

### **Incorporating Technical Analysis with Mobile Charting Tools**

Mobile trading on MT4 doesn’t compromise on analytical capabilities. The platform provides robust charting tools that allow investors to perform technical analysis on their mobile devices. Investors can draw trendlines, apply indicators, and analyze price patterns directly from their smartphones or tablets, ensuring that they can make informed decisions based on comprehensive market analysis.

### **Implementing Risk Management Strategies on Mobile**

Effective risk management is a cornerstone of successful investing, and MT4’s mobile platform empowers investors to implement risk management strategies on the go. Investors can set stop-loss and take-profit levels, modify existing orders, and monitor margin levels from their mobile devices. This real-time risk management capability enhances the overall control investors have over their portfolios.

### **Secure Access with Two-Factor Authentication**

Security is a top priority in mobile trading, and MT4 addresses this concern with two-factor authentication. Investors can enable an additional layer of security to protect their accounts, ensuring that unauthorized access is mitigated. This feature enhances the safety of mobile trading, giving investors confidence in the integrity of their accounts.

### **Multi-Language Support for Global Accessibility**

Modern investors often operate in a global market, and MT4’s mobile app caters to this diversity with multi-language support. Investors can access the platform in their preferred language, breaking down language barriers and ensuring a user-friendly experience for investors around the world.

### **Conclusion: Empowering Investors with Mobile Trading Freedom**

MT4’s mobile trading capabilities redefine the way modern investors engage with the financial markets. The platform’s seamless transition, real-time notifications, and comprehensive analytical tools provide investors with the freedom to trade and manage their portfolios anytime, anywhere. Whether executing trades, implementing risk management strategies, or staying informed through push notifications, MT4’s mobile platform empowers investors with the flexibility and convenience needed to thrive in today’s dynamic investment landscape. As the financial markets continue to evolve, MT4 remains a key ally for the modern investor seeking success on the go.