The gig economy, characterized by short-term and freelance work, has redefined traditional employment structures, offering individuals flexibility in their professional lives. In this dynamic landscape, some individuals turn to alternative means of income generation, such as CFD (Contract for Difference) trading. This article explores the intersection of CFD trading and the gig economy, highlighting the opportunities and challenges of balancing flexibility and stability in this unique context.

**1. Flexibility of CFD Trading:**

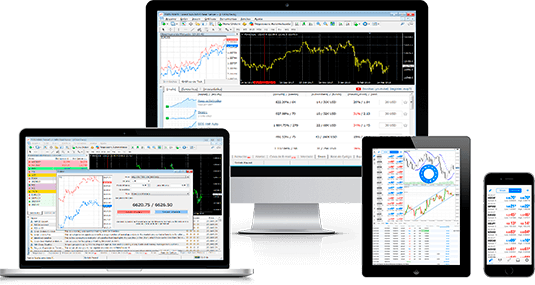

One of the primary attractions of cfd trading for gig workers is its inherent flexibility. Traders can engage in CFD trading from virtually anywhere with an internet connection, allowing them to adapt their trading activities to fit their gig work schedules and personal commitments.

**2. Parallel Income Streams:**

CFD trading provides gig workers with an opportunity to establish parallel income streams. As gig workers navigate the ebb and flow of freelance projects, CFD trading allows them to potentially generate additional income without committing to a rigid working schedule. This versatility is particularly appealing for those seeking diversified revenue streams.

**3. Independent Entrepreneurship:**

Gig workers often embrace the spirit of independent entrepreneurship. CFD trading aligns with this mindset, empowering individuals to take control of their financial destinies. Traders can manage their portfolios, make strategic decisions, and chart their own course in the financial markets, mirroring the autonomy experienced in the gig economy.

**4. Learning and Skill Development:**

For gig workers looking to enhance their financial literacy and acquire new skills, CFD trading presents a valuable learning opportunity. Engaging in the financial markets allows individuals to deepen their understanding of economic trends, market dynamics, and risk management strategies, fostering continuous skill development.

**5. Balancing Risk and Reward:**

While flexibility is a key advantage, gig workers engaged in CFD trading must navigate the delicate balance between risk and reward. The volatile nature of financial markets means potential profits come with the risk of losses. Traders in the gig economy need to approach CFD trading with a clear risk management strategy to mitigate potential downsides.

**6. Market Research and Time Management:**

Success in CFD trading requires a commitment to market research and effective time management. Gig workers juggling multiple projects and commitments must allocate dedicated time to stay informed about market trends, economic indicators, and other factors influencing CFD prices. Diligent research contributes to informed trading decisions.

**7. Emotional Discipline:**

The gig economy and CFD trading share a common challenge – emotional discipline. With the potential for both financial highs and lows, gig workers engaging in CFD trading need to maintain a disciplined mindset. Emotions such as fear and greed can impact trading decisions, emphasizing the importance of a rational and disciplined approach.

**8. Adapting to Market Changes:**

The gig economy and financial markets are both subject to change. Gig workers engaging in CFD trading should be adaptable and responsive to shifts in market conditions. This flexibility enables them to adjust their trading strategies in response to evolving economic landscapes.

**9. Networking and Community Engagement:**

Both the gig economy and CFD trading benefit from networking and community engagement. Gig workers can leverage online platforms and communities to share insights, strategies, and experiences in CFD trading. Building a supportive network enhances learning and fosters a sense of community in this dynamic intersection.

**10. Long-Term Planning:**

As gig workers explore CFD trading, long-term planning becomes essential. Balancing the flexibility of gig work with the stability sought through CFD trading requires a strategic approach. Gig workers should align their trading activities with their long-term financial goals, considering factors such as retirement planning and wealth accumulation.

In conclusion, the intersection of CFD trading and the gig economy presents a unique blend of flexibility and stability for individuals seeking diverse income streams. By embracing the autonomy of independent entrepreneurship, acquiring financial literacy, and balancing risk and reward, gig workers can effectively navigate the opportunities and challenges at the crossroads of CFD trading and the gig economy.